By helping you develop a better connection with your money, the financial wellness app Stackin enables you to give priority to the things that make you happy.

It’s crucial to understand that the problem isn’t you; it’s what you weren’t taught if you’ve had trouble sticking to a budget or are frequently perplexed by where your money has gone.

It’s easy to grasp budgeting on its own. Being debt-free, however, involves more than just knowing your statistics; it also involves realizing that your larger set of beliefs affects how you see and utilize money. Furthermore, feeling in control necessitates more than a sizable savings account.

It requires effort and helps to have a healthy relationship with money. You won’t likely be able to reach financial well-being if your fundamental relationship with money is damaged.

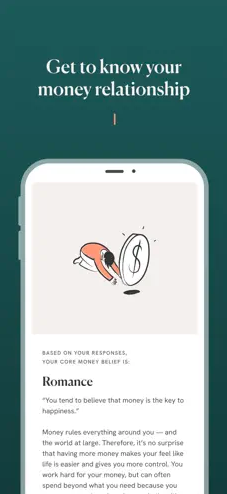

Everybody can use Stackin, regardless of where they are in their financial path. Discover your individual money belief by taking the money relationship questionnaire, then use the customized coaching material and concrete strategies to achieve your objectives.

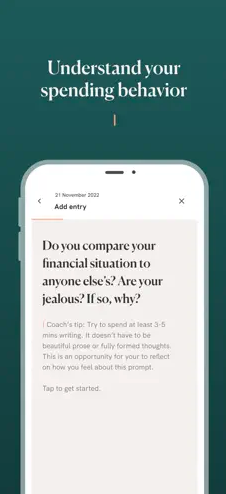

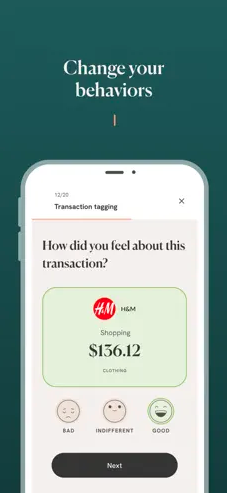

To help you become conscious of and learn to control the behaviors that underlie your financial decisions, Stackin offers the required financial therapy and coaching. By doing this, you can free yourself and go on your financial journey with peace and confidence.

————

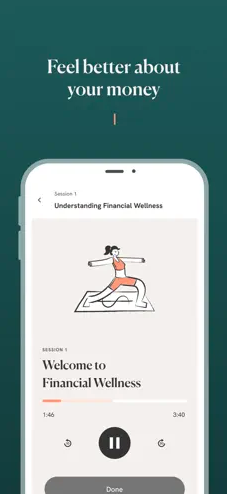

Consider Stackin as a form of wallet treatment that can help you develop a stronger bond with your money. Here is what we do:

- Identifying your relationship with money is the first step toward understanding it. Take the financial evaluation to find out what your money beliefs are and where they come from so that we can assist you to decide what needs to be your top priority.

- Together, we will define and establish intentions that will inspire you, then turn those intentions into concrete steps that will enable you to achieve your objectives.

- To cultivate a good money mindset, discover the “why” behind your spending habits by diving into the customized coaching content that has been created in collaboration with top financial therapists.

- Enhance your skill set by investigating the resources and structure we offer to assist you in taking charge of your finances and making choices that will help you achieve your long-term objectives.

Science supports it, as do we.

Our method is based on cutting-edge research in financial treatment and tested therapeutic techniques. Our method for enhancing your relationship with money is based on the Ford Financial Empowerment Model (FFEM) and combines the mental growth provided by cognitive behavioral therapy (CBT)—along with other therapeutic interventions—with the development of money management skills.

Terms of Use (EULA):

https://www.apple.com/legal/internet-services/itunes/dev/stdeula/