Betterment is an online financial advisor that aims to help you make the most of your money. You can use their smart money manager to accomplish this.

Cash management, guided investing, and retirement planning are all aspects of financial management that Betterment provides. It acts as your fiduciary, ensuring that your interests are protected.

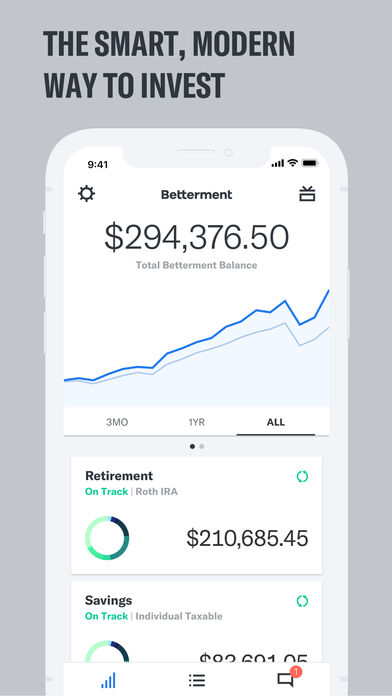

Check your account on the fly

You can see your current balance and any deposits or withdrawals.

Deposits and transfers

Anything you require to start saving, continue saving, move money, or withdraw money, just do it.

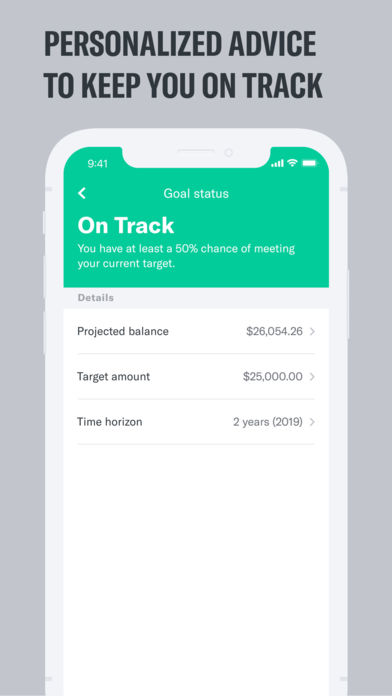

Performance tracking

Sign up for free and track your goals and money.

Add investing goals

Make a new goal, and start saving to get what you must have.

Speak to a financial advisor

Betterment is available for immediate support from a financial advisor. You can reach them through text message just as you would a friend. You can use this feature for as long as possible without paying anything.

App fees

You can manage your portfolio using the Betterment mobile app without paying a fee. Historical low costs are just one of the reasons why Betterment was one of the first alternative, low-cost investing firms.

Final thoughts

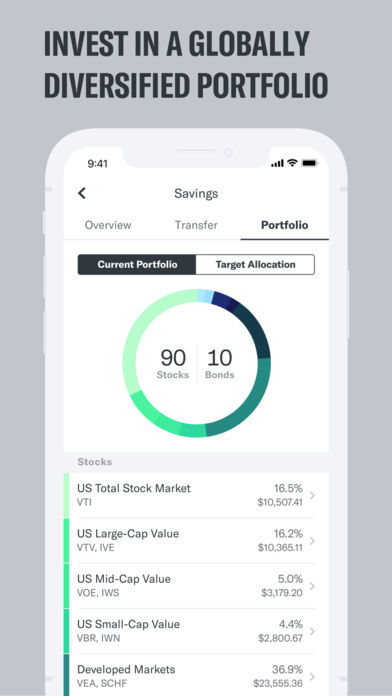

Betterment is different from other financial advisors. Unlike the traditional, expensive, one-size-fits-all portfolio model, Betterment is designed for how you invest now.

Betterment employs a multi-tiered investing approach, creating an account structure that works best for you. You choose the type of investments you want to make, while Betterment selects the kind of financial advisor you need. The goal is to make investing simple and accessible. That way, you can take control of your financial future.

Betterment’s goal is to give you access to the best possible advice with zero second-guessing. If you’re ready to take control of your money and improve your financial future, you owe it to yourself to check out what Betterment offers.